TV’s tough trajectory

2022 was just one of the toughest a long time ever for standard television businesses — and it’s only expected to get worse as the advert marketplace proceeds to slow and wire-chopping accelerates.

Why it matters: The changeover to streaming has wreaked havoc on the enterprise designs of important media companies, driving a new wave of consolidation and putting scaled-down channels’ survival at danger.

State of engage in: Paramount, Warner Bros. Discovery and NBCUniversal are all anticipated to provide or mix with other media entities in the upcoming handful of many years, in get to give their businesses the scale essential to maybe compete with tech firms like Amazon, Netflix and Google.

- Smaller Tv businesses are also scrambling to alter. Lionsgate is hunting to spin off Starz. Paramount is starting to bundle Showtime with its most important streaming support. AMC Networks is laying off 20{38557cf0372cd7f85c91e7e33cff125558f1277b36a8edbab0100de866181896} of its workers.

Facts: Most problems plaguing Television giants right now stem from the fake assumption that streaming would be capable to effortlessly make up for linear Television set losses.

- Paramount, Warner Bros. Discovery, Disney and Comcast will not count on their standalone streaming choices to split even until 2024 or 2025 at the very least.

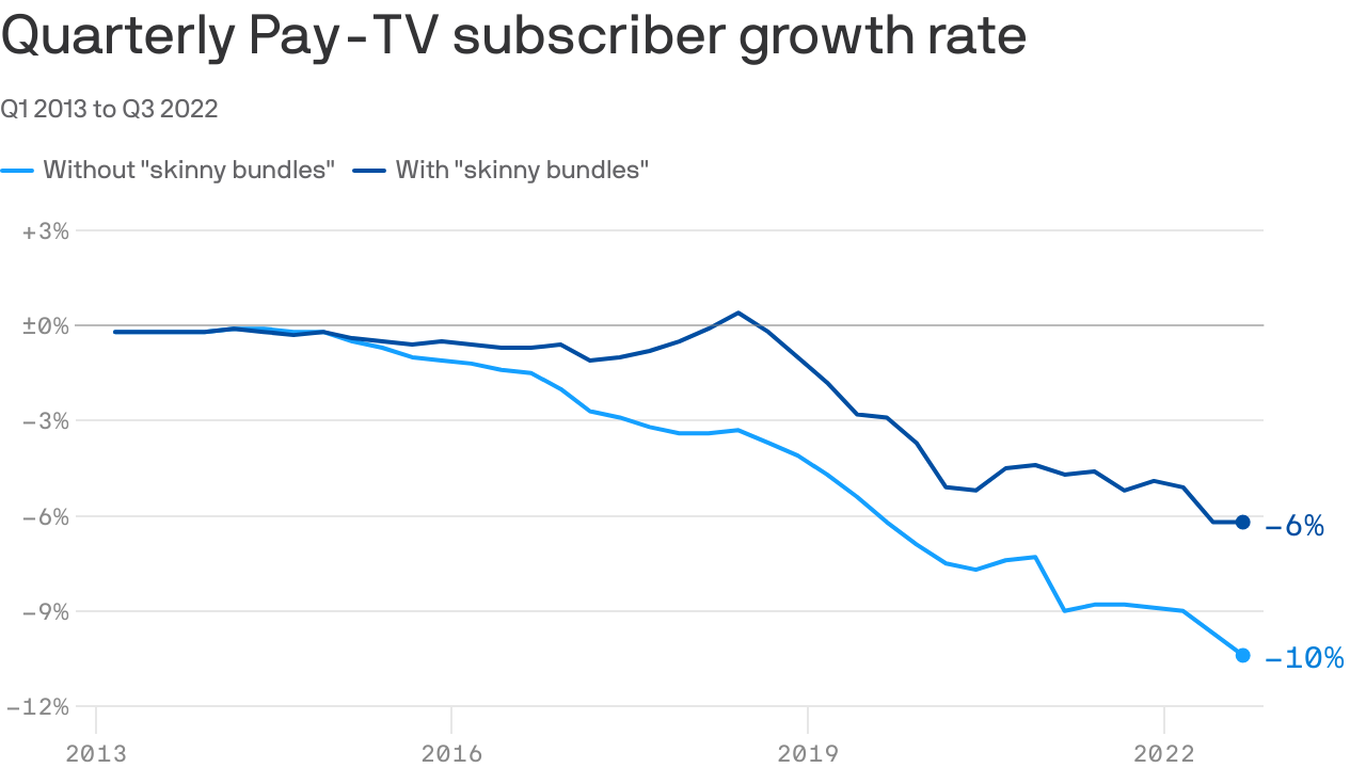

- In the interim, not only is cord-cutting accelerating speedier than anticipated, but so are drops in linear Tv viewing broadly, including broadcast.

- Electronic “skinny bundles,” like Sling Television set or Hulu with Stay Tv, are not expanding more than enough to make up for the declines normal cable deals.

- Now, around two-thirds of U.S. homes pay back for a cable, satellite or fiber Tv set subscription, down from 79{38557cf0372cd7f85c91e7e33cff125558f1277b36a8edbab0100de866181896} in 2017 and 85{38557cf0372cd7f85c91e7e33cff125558f1277b36a8edbab0100de866181896} in 2007.

Zoom in: Media giants are possessing a specially tricky time convincing Wall Avenue that their streaming bets will finally pay out off.

- Regardless of surpassing expectations for new subscribers, Disney’s stock cratered to its most affordable degree in 21 many years final quarter, thanks to widening losses in its streaming division.

- The number of corporations that have opted not to enter the subscription streaming wars, like Fox Corp., have fared far better amongst buyers.

Between the lines: The migration of the country’s largest sporting activities rights packages from linear Television networks to streaming will expedite the inevitable collapse of the cable bundle.

- The NFL final 7 days mentioned its coveted Sunday Ticket legal rights deal will be awarded to YouTube starting up coming season. It is the next main NFL deal to transfer completely to a Huge Tech agency, next the NFL’s landmark Thursday Night Soccer offer with Amazon.

- Google will pay back approximately $2 billion a year for the bundle, up from the about $1.5 billion that DirecTV at the moment pays to distribute the game titles. Amazon is paying out about $1 billion on a yearly basis for Thursday night video games, up from the documented $650 million per 12 months that Fox formerly paid out.

The large picture: Nowadays, most media giants are still left in limbo, attempting desperately to enjoy what’s still left of their lucrative linear tv firms when at the same time investing in their costly new streaming services.

- Almost each individual streamer has released an advert-supported streaming tier, in an exertion to lure a lot more subscribers as levels of competition heats up.

- Some companies, like Warner Bros. Discovery, are commencing to license additional of their courses to other Television set distributors, just after originally hoarding their possess content material to strengthen their possess standalone solutions.

Go further:

:no_upscale()/cloudfront-us-east-1.images.arcpublishing.com/dmn/3O64XIWTM5FNHH2XDY7VI6AOMQ.jpg)