Late payments? Ford applies for patent to repossess cars remotely

Ford Motor Co. has utilized for a patent on a procedure created to consider and get folks to very clear up late motor vehicle payments that, when all else fails, could lead to cars driving themselves to repo plenty.

A patent application from Ford World Technologies was filed with the U.S. Trademark and Patent Place of work on Aug. 20, 2021, and formally released Feb. 23 for community evaluate as component of the formal approach.

The patent is pending, not nonetheless granted, Ford spokesman Wes Sherwood confirmed to the Detroit Cost-free Press on Wednesday.

The patent software describes new “programs and procedures to repossess a vehicle.” Inventors are stated as Anthony Maraldo, of Southgate Brendan Diamond, of Grosse Pointe Keith Weston, of Canton, and Michael Alan Mcnees, of Flat Rock, all Ford engineers.

They describe in the patent software a variety of opportunities that incorporate the vehicle driving itself off personal residence to be picked up by a tow truck or using it to a junkyard if the benefit is way too very low based mostly on mileage and other factors.

Prevent ‘confrontation’

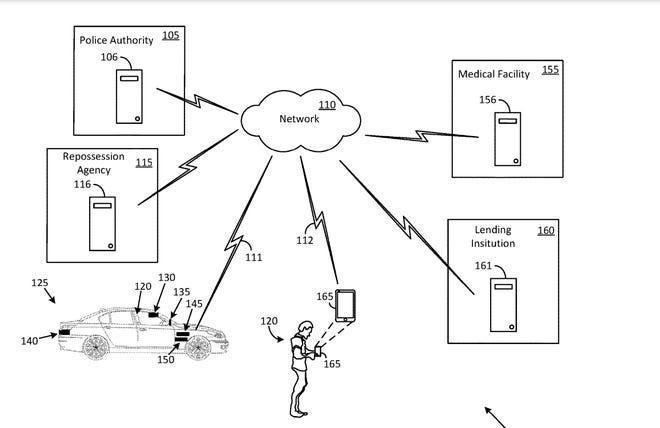

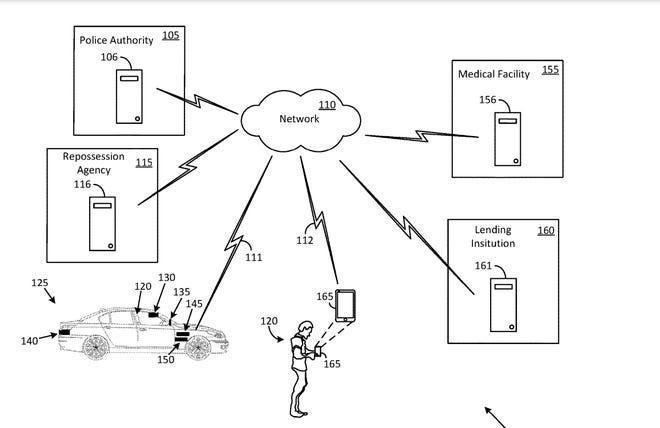

The patent application reviewed by the Absolutely free Push outlines a sequence of tactics to resolve nonpayment, which include sending reminder messages and a warning from banking companies or other lending establishments to the owner’s smartphone or car display screen display.

Right after a interval of days or months, the method may possibly evolve to incorporate audio that helps make an “unpleasant” sound with tone, pitch, cadence, beat or volume to get the proprietor to call the lender about arranging payment. Then the motor vehicle may well disable options these kinds of as window or seat controls, GPS or radio dials to “bring about irritation,” the patent said.

The internet pages of the patent application spelled out in fantastic detail how the layout and embedded application might be utilised and mentioned that it truly is “preferable not to provoke an unwanted confrontation.”

Will it or will not it be made use of?

The patent also spells out approaches that delinquent proprietors can retain their car whilst working toward payment, this kind of as locking the car on weekends only so that the driver can nevertheless entry a career or geofencing the vehicle’s variety.

“The initially point to know is that if your auto is linked to the net in any way, this technique could theoretically work on it. The application furthermore describes a ‘repossession computer’ that could be mounted on long run cars to make this program function effortlessly, but it also states no further components automatically wants to be set up on the car for it to operate,” stated thedrive.com, which very first documented the news Monday. “Mainly, if your auto has an infotainment technique by now established up to receive one thing like above-the-air updates, this could almost certainly operate devoid of physical modifications.”

The Dearborn automaker declined to comment on no matter whether the firm strategies to implement the plan for a new software program in any of its motor vehicles by way of manufacturing facility set up or over-the-air updates.

Car repossessions climbing nationally

The new technique has not been put in in latest Ford goods, and the firm are not able to talk about potential programs, Sherwood instructed the Absolutely free Press on Wednesday.

“We post patents on new innovations as a typical training course of business but they are not necessarily an indication of new company or solution options,” he stated.

Extra:I bought an previous BMW and my husband apologized to household users

Even though Ford owns a funding entity known as Ford Credit rating, the 2022 Ford company earnings presentation in fact showed a constant decline in repossessions from 2018 by means of 2022.

However, consumer tendencies demonstrate banks and other lending establishments may perhaps be wanting to get much more aggressive.

In December, NBC Information noted people ended up slipping behind on car or truck payments. A month later, Bloomberg reported, “Us citizens fell driving on car or truck payments at a greater level than in 2009. Auto repossessions climbing …”

Years ago, Mel Farr, a Detroit Lions managing back who retired in 1974 and purchased his initial Ford dealership in 1975 and went on to operate an automotive empire, manufactured headlines for employing a machine to disable autos he leased out when customers unsuccessful to make timely payments. In accordance to a Free of charge Press article in 2000, attorneys for 1,550 prospects agreed to fall a class action lawsuit towards Mel Farr Automotive Group about the engine disabling gadget in trade for $200 in coupons for vehicle solutions at the dealership.

Farr was keen to do the job with consumers with undesirable credit and did so with superior interest costs, but some customers alleged their autos shut down although they were being driving. He died at age 70 in 2015.

More:OnStar faces firestorm around newborn in locked motor vehicle, tries to describe what occurred

Much more:Why Ford is heating inside of of law enforcement SUVs to 133 degrees

Information in this short article was edited after publishing.

Make contact with Phoebe Wall Howard at 313-222-6512 or [email protected]. Adhere to her on Twitter @phoebesaid. Go through a lot more on Ford and signal up for our no cost autos publication.