For new hardware companies, waiting is the hardest part

In context: The biggest difference between building hardware and software is the amount of time it takes to get to first revenue. There are no easy ways to shorten this, but there are ways to adapt and ease the path to revenue growth.

We obviously have strong biases when it comes to the benefits of investing in hardware versus investing in software. And we have some strong opinions on the investment cases for each being much more similar than the common wisdom holds. Nonetheless, there are obvious differences between the two, and we want to explore those differences with the end goal of finding ways to de-risk hardware investing, or the least, finding accommodations to level out long-term outcomes.

Editor’s Note:

Guest author Jonathan Goldberg is the founder of D2D Advisory, a multi-functional consulting firm. Jonathan has developed growth strategies and alliances for companies in the mobile, networking, gaming, and software industries.

Unquestionably, one of the biggest benefits of starting a software company is how quickly a company can get to revenue. The proverbial two engineers in a dorm room can build a real product and get to revenue almost literally overnight.

The world of hardware, especially semis, is very different. In fact, if we had to name the single most important difference between the two it comes down to timing.

Building hardware just takes time. Design the product, re-think the design, build a prototype, fix the mistakes, redesign, build for manufacture, then enter intro production. There are just a lot more steps involved, and usually many of those steps are dependent on other companies further adding to the time.

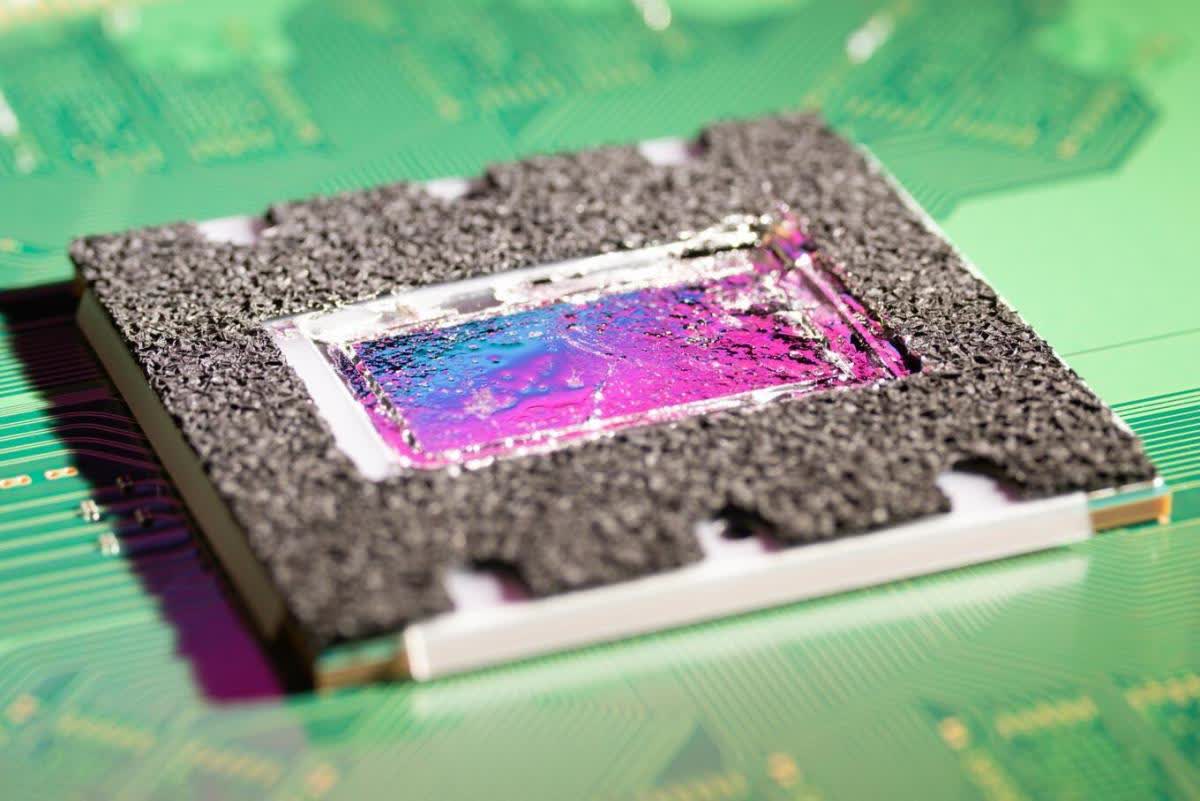

Take the example of a semiconductor. We recently worked with a team of 20. They designed their chip in just under six months. This was an incredibly seasoned team and so there were no doubts that their design would work. Then they had to spend a month plugging their data into TSMC’s software interface (a.k.a. the PDK). They sent their libraries and TSMC ‘taped-out’ their chip and three months later, they got first silicon back and had to go through a few more months of testing and packing.

All together about a year from napkin to first working sample. Note that over half the time was taken by outside parties. For those not familiar with semis design this sounds like an excruciatingly long time. Those familiar with semis design will be amazed at how quick this team moved. Seriously – 20 people in under six months! This was not a small chip either.

There are no easy ways around this. Software can be patched in real-time, but once hardware goes out the door there is no way to fix it.

So the question then becomes how to deal with this reality.

For one, it has become a little easier to build prototype chips. There are a growing number of “Free Tape Out” programs, with many trailing edge foundries offering cheap pricing for small runs. For larger, process-dependent chips, emulation on FPGAs works fairly well. This is not ideal as customers will not commit until they see working silicon, because they will want to run their own evaluations (and do not get us started on how long the whole EVT/PVT/DVT cycle can take). But these methods can at least demonstrate to investors and customers that the product has something to offer.

Another important adaptation will be to shift to a “solution” sale, in which companies sell some form of service on top of the chip. This can be a complete hardware module (with chips and a board) or increasingly it can mean software running on the chip. We have written on this subject in the past. It is difficult to achieve but has benefits.

The ideal would be for a chip company to design a standard product whose features can be enhanced via periodic software updates. This is firmly in the camp of “If you can’t beat them join them”, borrowing a page from software companies. This does not get to first revenue faster, but it does pave the way for incremental sales, easing the path to growth.

The obstacle to this path is that it really entails an entirely new business model, not just a new product. The semis industry is largely built on habits of product sales, but this model requires a “solution sale,” which most big chip companies are not equipped to provide.

None of this will shorten the time to revenue much, but it does provide a fairly solid adaptation. And not for nothing, gives everyone something to do while waiting for first silicon to come back from the foundry.